Section 179 Bonus Depreciation 2024 For Home. The expensing limit was doubled from $500,000 to $1. For vehicles under 6,000 pounds in the tax year 2023, section 179 allows for a maximum deduction of $12,200 and bonus depreciation allows for a maximum of $8,000, for a total.

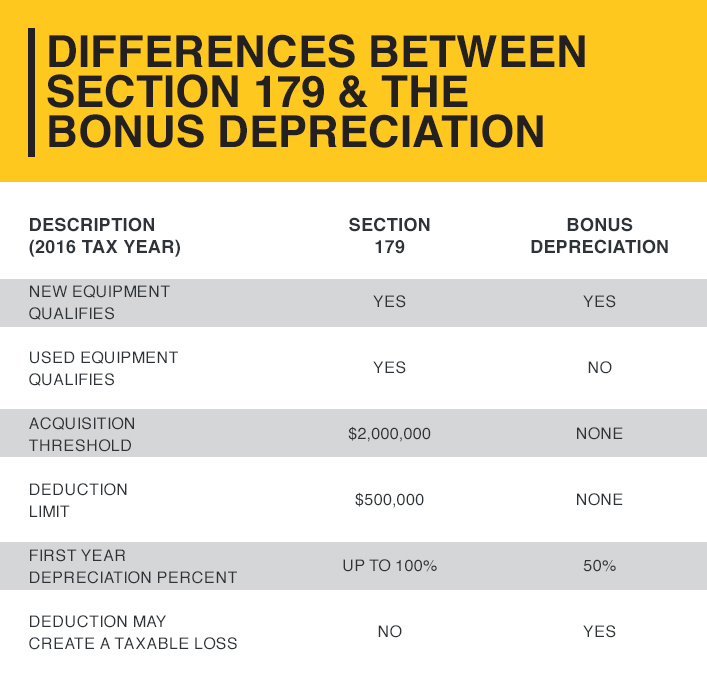

Simply enter the purchase price. Section 179 versus bonus depreciation understanding the differences, bonus depreciation gives taxpayers the ability to expense up to 60% of the cost of assets placed in service during the.

Section 179 Bonus Depreciation 2024 For Home Images References :

Source: www.clevelandbrothers.com

Source: www.clevelandbrothers.com

How to Writeoff Your Equipment Purchases Cleveland Brothers Cat, If purchases exceed these thresholds, the deduction limit.

Source: nevsaqkaylyn.pages.dev

Source: nevsaqkaylyn.pages.dev

Section 179 And Bonus Depreciation 2024 Lenka Imogene, For tax years beginning in 2024, the maximum section 179 expense deduction is $1,220,000.

Source: www.netsapiens.com

Source: www.netsapiens.com

Section 179 IRS Tax Deduction Updated for 2024, Recording the depreciation expense of an asset using section 179 or bonus depreciation can make a huge difference in the taxes you pay.

Source: www.unitedevv.com

Source: www.unitedevv.com

Section 179 and Bonus Depreciation at a Glance United Leasing & Finance, Bonus depreciation is limited to 60% in 2024.

Source: www.calt.iastate.edu

Source: www.calt.iastate.edu

Line 14 Depreciation and Section 179 Expense Center for, For tax years beginning in 2024, the maximum section 179 expense deduction is $1,220,000.

Source: veronikawflo.pages.dev

Source: veronikawflo.pages.dev

2024 Bonus Depreciation Percentage Table Nelie Xaviera, 179 expensing, a manufacturer can elect to expense 100% of the cost of qualified property up to a specified maximum.

Source: zeldaqbernadette.pages.dev

Source: zeldaqbernadette.pages.dev

Bonus Depreciation Limits 2024 Dita Donella, 179 expensing, a manufacturer can elect to expense 100% of the cost of qualified property up to a specified maximum.

:max_bytes(150000):strip_icc()/Term-Definitions_Section-179-resized-1a04b9f84c4d4141b11d1d9ca10fb981.jpg) Source: cabinet.matttroy.net

Source: cabinet.matttroy.net

Irs Depreciation Tables For Computers Matttroy, 179 deduction for tax years beginning in 2024 is $1.22 million.

Source: www.youtube.com

Source: www.youtube.com

6000lb Bonus Depreciation Rule Section 179 Explained YouTube, In 2024, the section 179 deduction limit increases to $1.22 million, with a spending cap on eligible purchases for $3.05 million.

Source: investguiding.com

Source: investguiding.com

Bonus Depreciation vs. Section 179 What's the Difference? (2024), Simply enter the purchase price.

Category: 2024